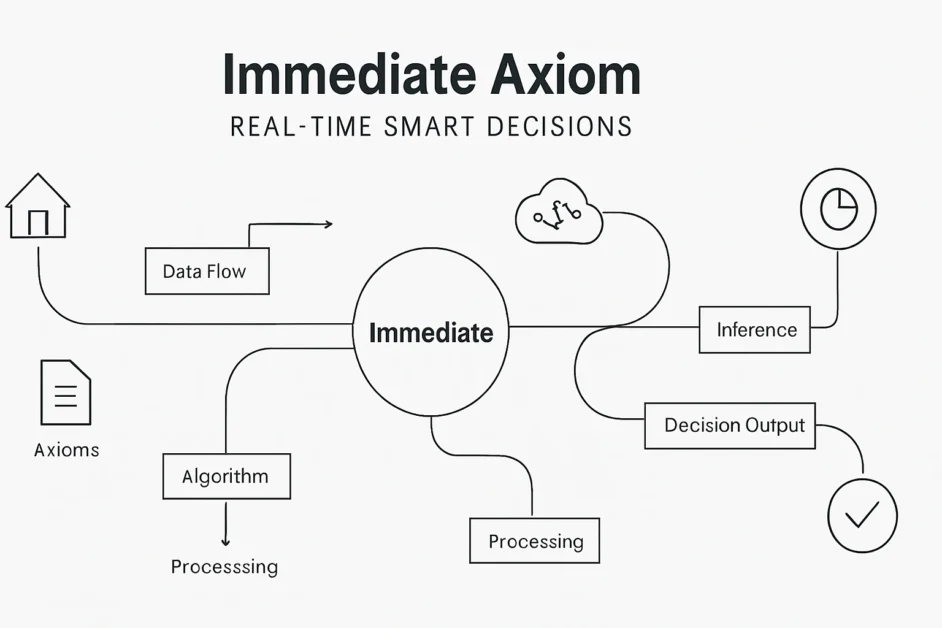

As modern finance evolves, the speed of making decisions and leveraging information should improve. Automated trading systems are systems specialised in executing specific trades automatically. This is done by programming an ATS to follow pre-determined instructions. One factor that has boosted the efficiency of these systems is the implementation of logic-based platforms like the Immediate Axiom App, which performs using core principles of decision-making such as axioms.

What are automated trading systems?

Sometimes referred to as algorithmic trading platforms, automated trading systems (ATS) are software applications that automatically execute trades according to predetermined specifications like certain price thresholds, market volume, or specific times. The apparatus will automatically execute buy or sell orders if the conditions are filled with no human intervention.

ATS is collectively used by institutional investors, hedge fund managers, and even individual traders who aim to achieve consistency and speed in trading.

How Logic-Based Platforms Revolutionized The Trading Market

Unlike other trading methods that rely heavily on human traders, logic-based platforms automate the process. These platforms define an algorithmic trading strategy using axioms, defining how a given trade must be executed.

Advantages of Using Logic-Based Systems

Speed

The Immediate Axiom App is able to scan a multitude of info and make trades in the span of a few milliseconds.

Consistency

A set framework ensures that no illogical decisions are made or emotional biases are incorporated into trades.

Backtesting Capability

Traders can analyse the results of decisions made on historical data.

Scalability

Trade logic founded on axioms has minimal changes to be made in applying it to various assets or market conditions.

Real World Example: The Immediate Axiom App

The app has gained popularity as a result of its use of real-time axiomatic decision-making. Unlike other products that use AI models, these use foundational principles known as immediate axioms for critical decisions.

Such apps are useful whether one trades crypto, forex, or stocks, as they make sure that every action taken by a system is logical, and hence, they lower the risk while increasing performance.

Common Components of Automated Trading Platforms

- Rule-based execution

- Live market surveillance

- Scheduled and integrated risk aversion techniques

- Logic or axioms customization

- Immediate report generation

Common Mistakes to Avoid

Mistakes will make the most powerful platforms useless. Some common problems are:

- Having untested logic that is too complicated

- Failure to meet the demands of the shifting market

- Blindly ignoring the system’s limitations like slippage and latency

To avoid the issues, check out our guides discussing how to implement logical systems successfully.

Who Ought to Use These Systems?

- Day traders: For executing high-volume trades with minimal gaps in human interaction.

- AI developers who wish to incorporate algorithmic trading into their machine learning models.

- Financial analysts, starting from the financial world, seek to turn insights into logical actions.

- Novices: Due to the fact many platforms come equipped with drag-and-drop visual interfaces or intuitive rule builders.

Conclusion

Automated trading made possible by systems governed by logic-based frameworks is changing the marketplace. Just like other tools, the Immediate Axiom App offers a blended solution for speed, risk mitigation, and precision and provides users with decision-making power through rules.

Regardless of being a novice or a multi-millionaire, incorporating logical rules into your trading plan will put you ahead of others.

Research immediate axioms to find out how they can bolster your automated approach.